Car Insurance Moving Home

It should cover your possessions for damage and loss while they re being moved by a professional company.

Car insurance moving home. Besides packing moving and then unpacking all of your belongings you need to update your address and telephone number with any number of companies such as banks credit card companies and utility providers. Your responsibility does not end there. Get all your valuable possessions assessed for insurance. Car insurance you have a lot to consider when you move.

Some home insurance policies cover goods in transit it will either be included as standard or an optional extra. You ll need contents cover in place for the move to make sure your things are protected should they get damaged during the move. Sort out the old and new council tax. Check out our guide on arranging home insurance for a house move for loads more info.

Insurers take your postcode into account when they set the premiums for car insurance so you should contact your insurer immediately if you re moving home. Organise your new landline and broadband. Tell your bank the new address. Your car or van insurance.

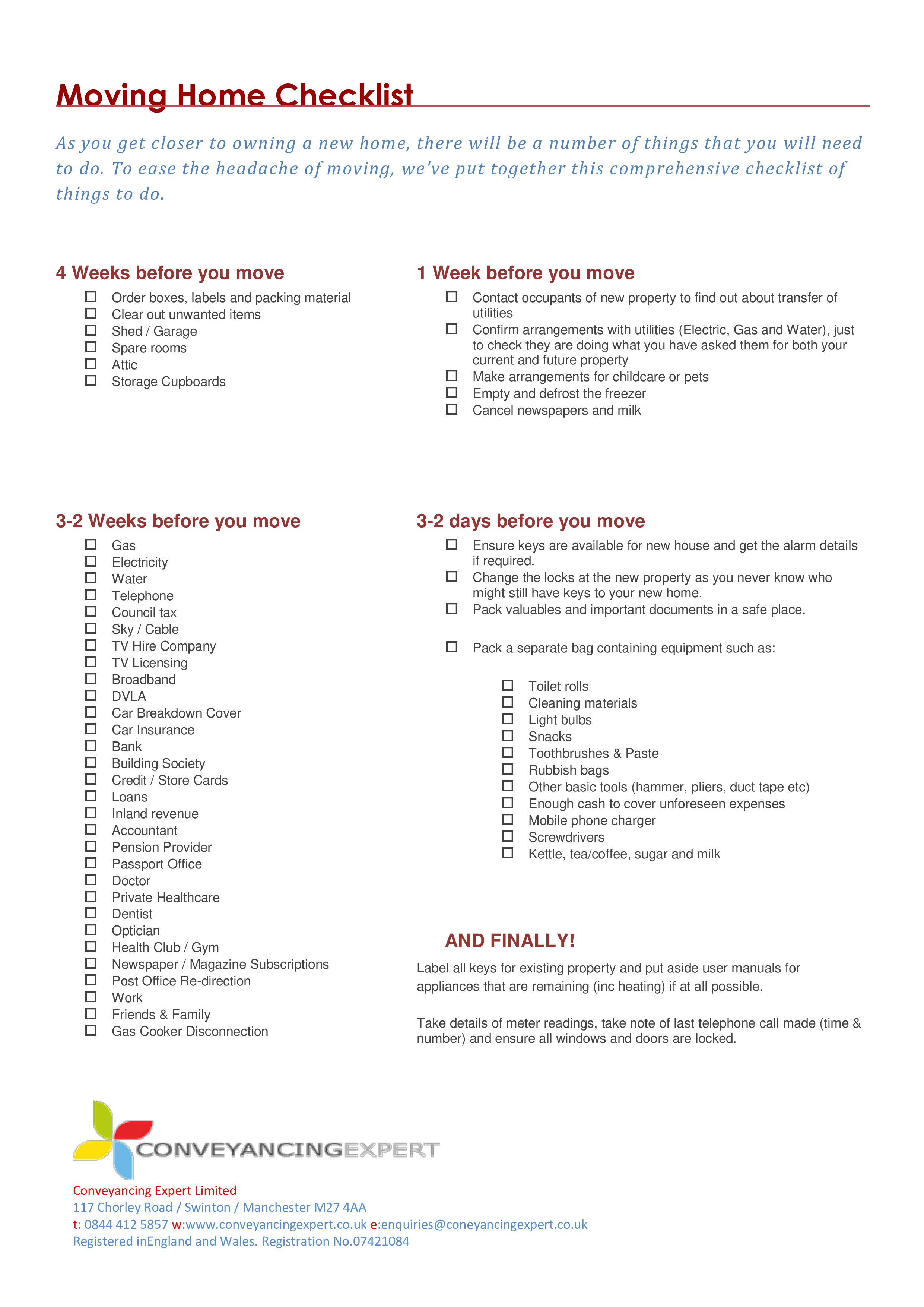

When you know your move date notify your insurance company straight away. Other than sorting out your insurance when moving home you should also remember to. What your home moving cover should include. We ve put together a full homebuyer s property checklist to make sure you don t forget anything.

If you re selling or buying get all the legal bits and bobs in place early including life insurance. We ve put together useful tips to consider when deciding to move house find out more. For some providers you ll have to call them while others accept address changes online. Moving house can be a stressful process.

A change of address can affect your motor insurance premium. If you re renting confirm your moving date with your current landlord. There are several factors that insurance companies take into consideration when calculating your car insurance premium and the location of your new property is one of them. You might not think a house move would affect your car insurance but you d be wrong.

There is a chance that your premium could fall. You will need house insurance cover in place from the day you exchange contracts on your new property to protect against storm damage or fire for example. Besides considering the type of home insurance you will need if you re moving it s also the perfect time to review your car insurance policy.

/GettyImages-554992005-56a0f4805f9b58eba4b586b6.jpg)