Car Insurance Michigan Rates

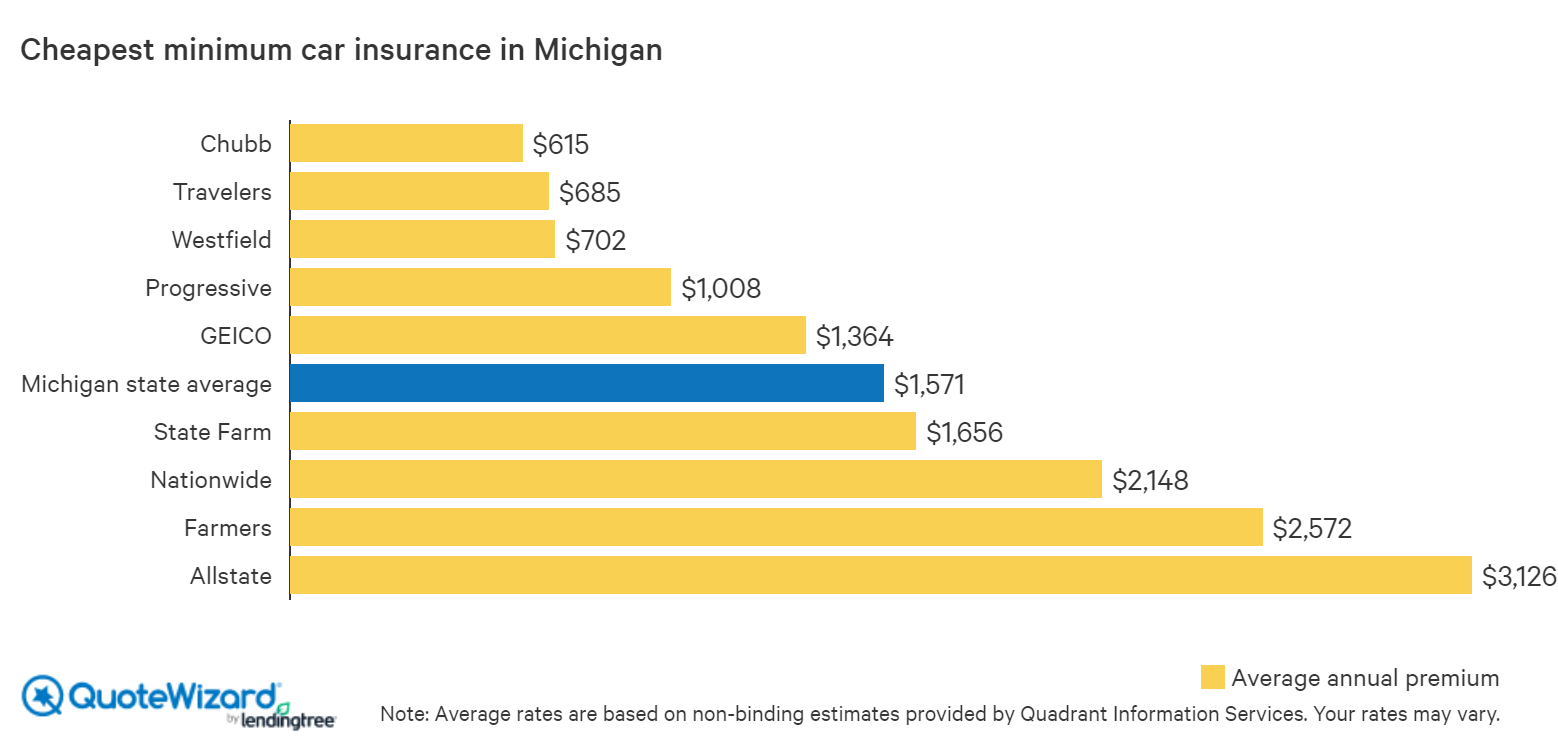

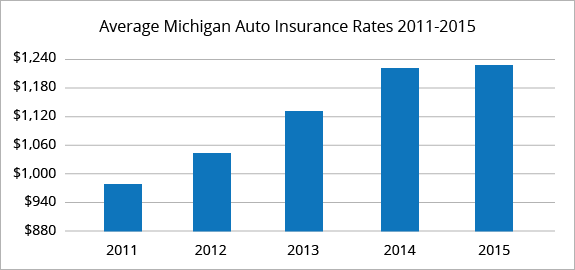

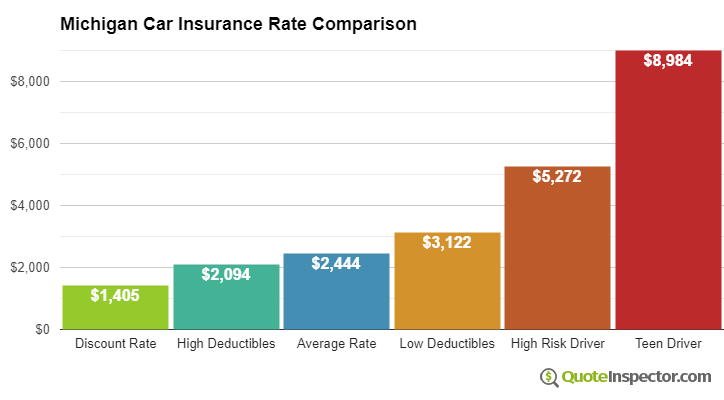

The average car insurance rate in michigan is 3 141 a year for a full coverage policy with a 500 deductible or about 262 a month.

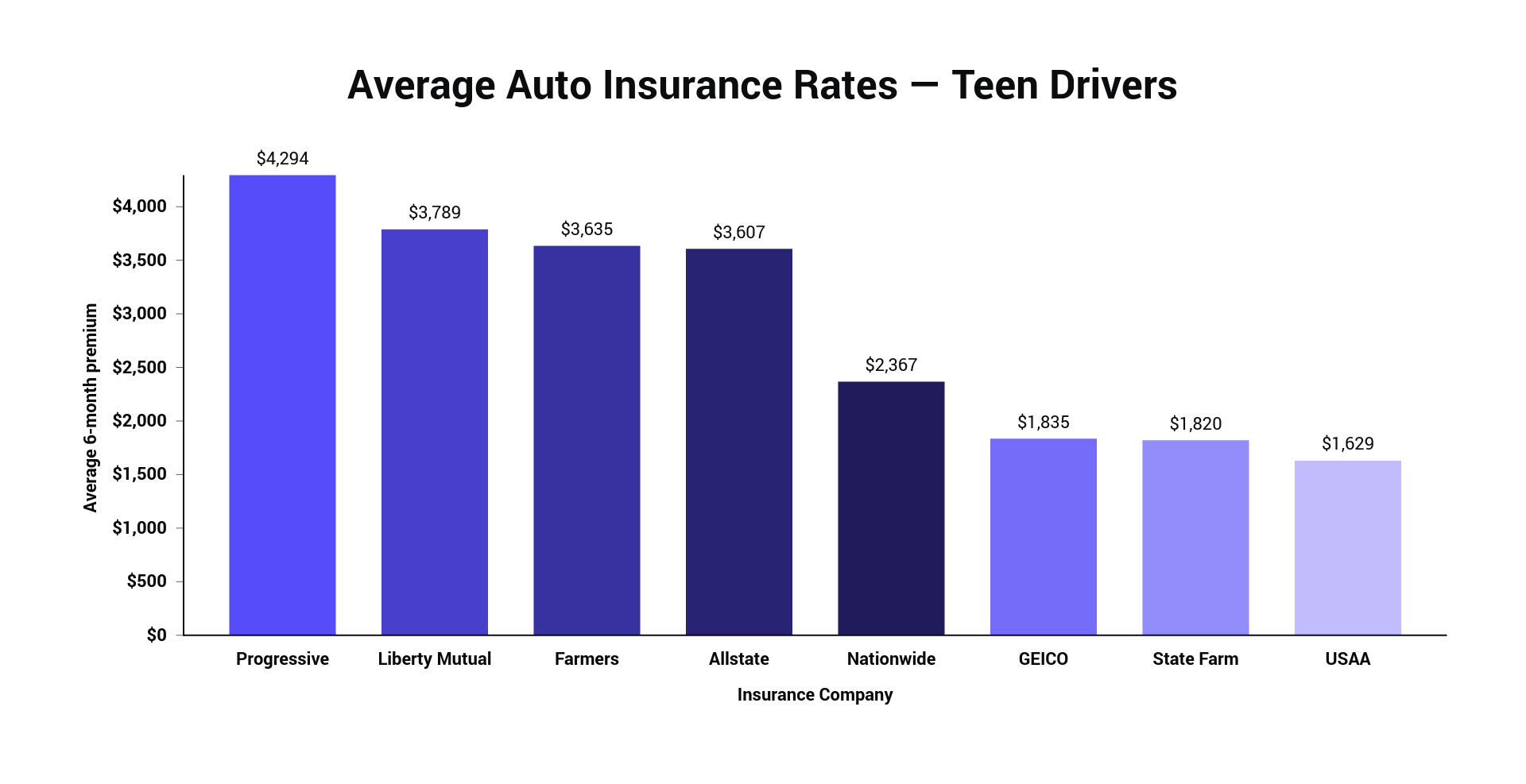

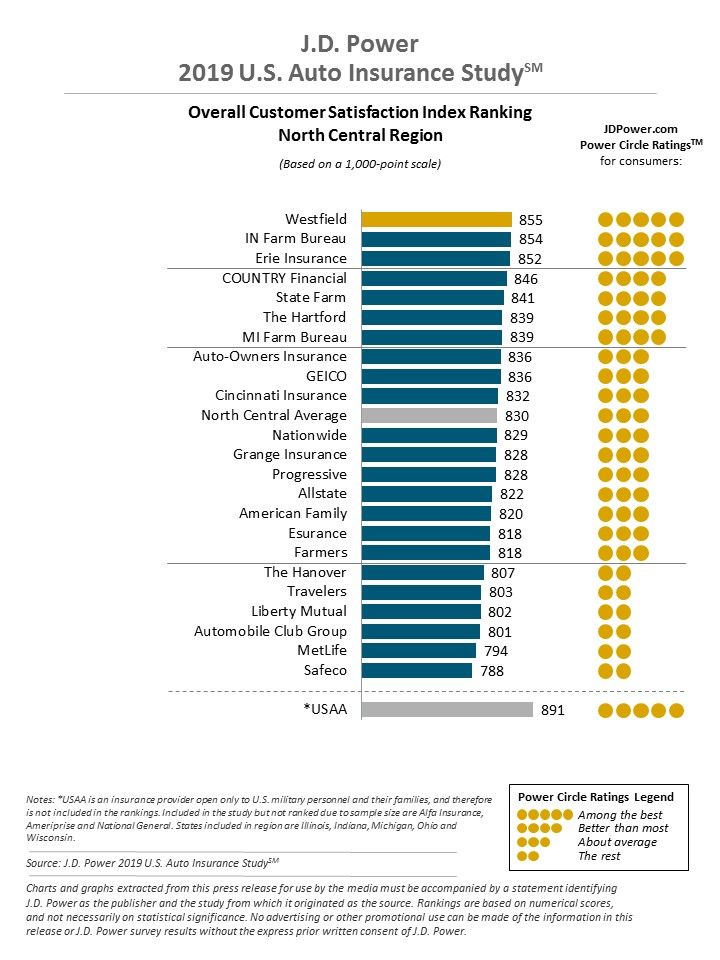

Car insurance michigan rates. After age 30 the effect diminishes. See what we need to provide with a totally free automobile insurance quote. Here are the cheapest average car insurance rates we found in michigan for all of the driver categories above. Amongst the largest business your background of mishaps tickets and various other violations will certainly influence your automobile insurance quote in very different means.

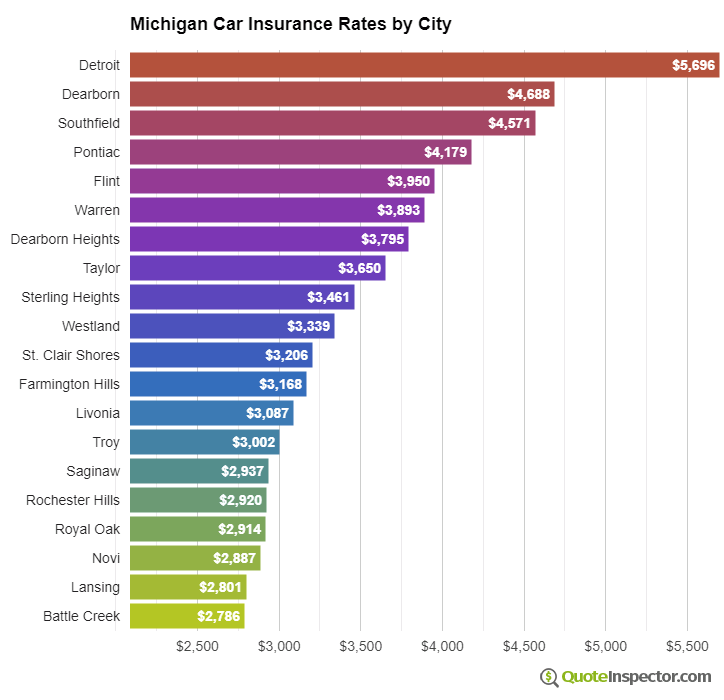

Part of the reason michigan car insurance is so expensive is because it is a no. While the national average for car insurance is usually between 1 200 and 1 300 per year michigan s average annual cost for standard auto insurance is known to top 2 200. Find the cheapest auto insurance rates in your area today. You may obtain a less expensive rate for becoming part of a professional company a college alum a fraternity sorority member or a member of aaa.

Geico 677 per year. But after age 65 insurance rates start to increase due to the increased. Take 5 minutes to save hundreds of dollars today. After a really serious mishap expenses for damage and injuries can conveniently reach into thousands of thousands of dollars.

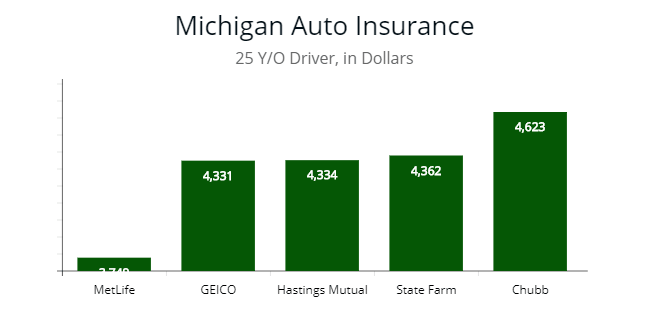

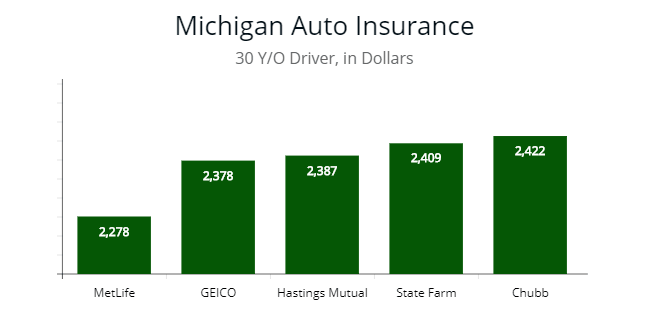

Age is a key variable in determining auto insurance premiums because it likely implies your level of driving experience. Compare auto insurance from car insurance providers in under 60 seconds save up to 50. The average full coverage premium in michigan is 3 141 making them the most expensive state for car insurance. A 30 year old single male driving a 2014 honda accord ex with a good driving history and coverage limits of.

Michigan car insurance rate data comes from the zebra s 2019 state of auto insurance report which analyzed 61 million unique rates to explore pricing trends across all united states zip codes including washington d c. There are quite a few reasons for this which we ll get into below. Every car insurance policy is tailored to every person s needs and quotes may be different as well. Analysis used a consistent base profile for the insured driver.

Compare insurance quotes from top lenders and get the best rate. With fewer years of driving experience comes a greater chance that your auto premiums will reflect this.

/cdn.vox-cdn.com/uploads/chorus_asset/file/13320489/TheZebra_Car_Insurance_Rates_Michigan_Nearby_States.jpg)

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/FRHDVL7ONNENJBM2SKL5OYBROQ.jpg)