Car Insurance In Florida Laws

Minimum coverage requirements are not very high compared with other states but it is also recommended that drivers purchase additional coverage to.

Car insurance in florida laws. Auto insurance isn t a should i or shouldn t i proposition. Car insurance laws in florida you should be aware of there are 2 laws every car driver should be aware of. When you register your vehicle you must have proof of florida coverage. Most states have laws requiring you to purchase at least some auto insurance.

If you are injured in an accident your car insurance will pay your medical costs up to your policy s limits regardless of who caused the accident. Other types of auto insurance coverage may be optional or. Florida car insurance laws. Florida has a no fault car insurance system.

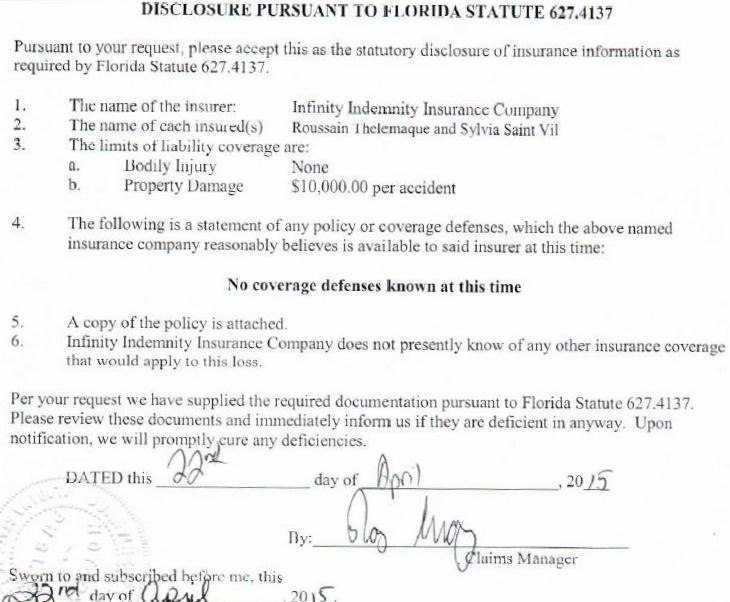

10 000 of no fault or personal injury protection pip insurance. Florida car insurance information. Car insurance laws in florida are a bit different than other states. Section 324 171 florida statutes outlines the financial requirements for the department to issue a certificate to qualified individuals.

Over 14 million drivers use florida s roads every year and they cause thousands of accidents so it s a good idea to pay attention to florida s car insurance laws. Auto insurance requirements in florida. Florida is a no fault insurance state. The first one is the financial responsibility law.

They do not legally require drivers to maintain bodily injury liability coverage but it is highly recommended to do so and many insurance companies won t sell a policy without it. Drivers are required to purchase personal injury protection pip coverage. The minimum limits for florida car insurance coverage are. According to florida statute 627 736 individuals who are injured in an accident must use their own personal injury protection coverage to pay for medical bills and financial losses up to the insurance policy s coverage limits regardless of who caused the accident.

By ross martin march 13 2020. The state of florida requires every vehicle with four or more wheels maintain florida auto insurance coverage. Florida law requires that all drivers must carry certain amounts of car insurance coverage. Sr22 an insurance filing certifying bodily injury liability bil and property damage liability pdl to comply with the reinstatement requirements of the florida financial responsibility law.

The minimum requirement is 10 000 personal injury protection pip and 10 000 property damage liability pdl. While specific requirements will vary from one state to another you will typically be required to buy some level of liability coverage. Florida car insurance requirements say all drivers must carry 10 000 in personal injury protection. However as a no fault state the requirements for florida drivers are quite different than in many states.