Car Insurance For New Drivers Rates

If you re unhappy with your current rate there.

Car insurance for new drivers rates. The provider has an a rating with the better business bureau bbb an 8 out of 10. Driver was excited to get her new car until she discovered that under icbc s new rate structure she ll pay more every year for insurance than she paid for the car. Erie car insurance provides some of the best choices for car insurance for new drivers. So if you are a young driver you can pay significantly more than older drivers.

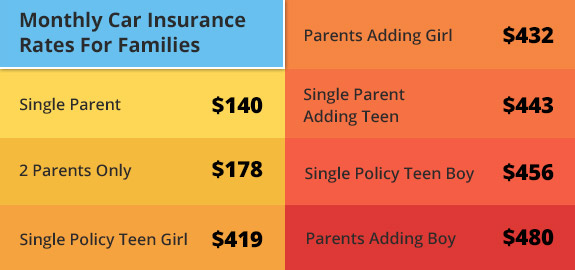

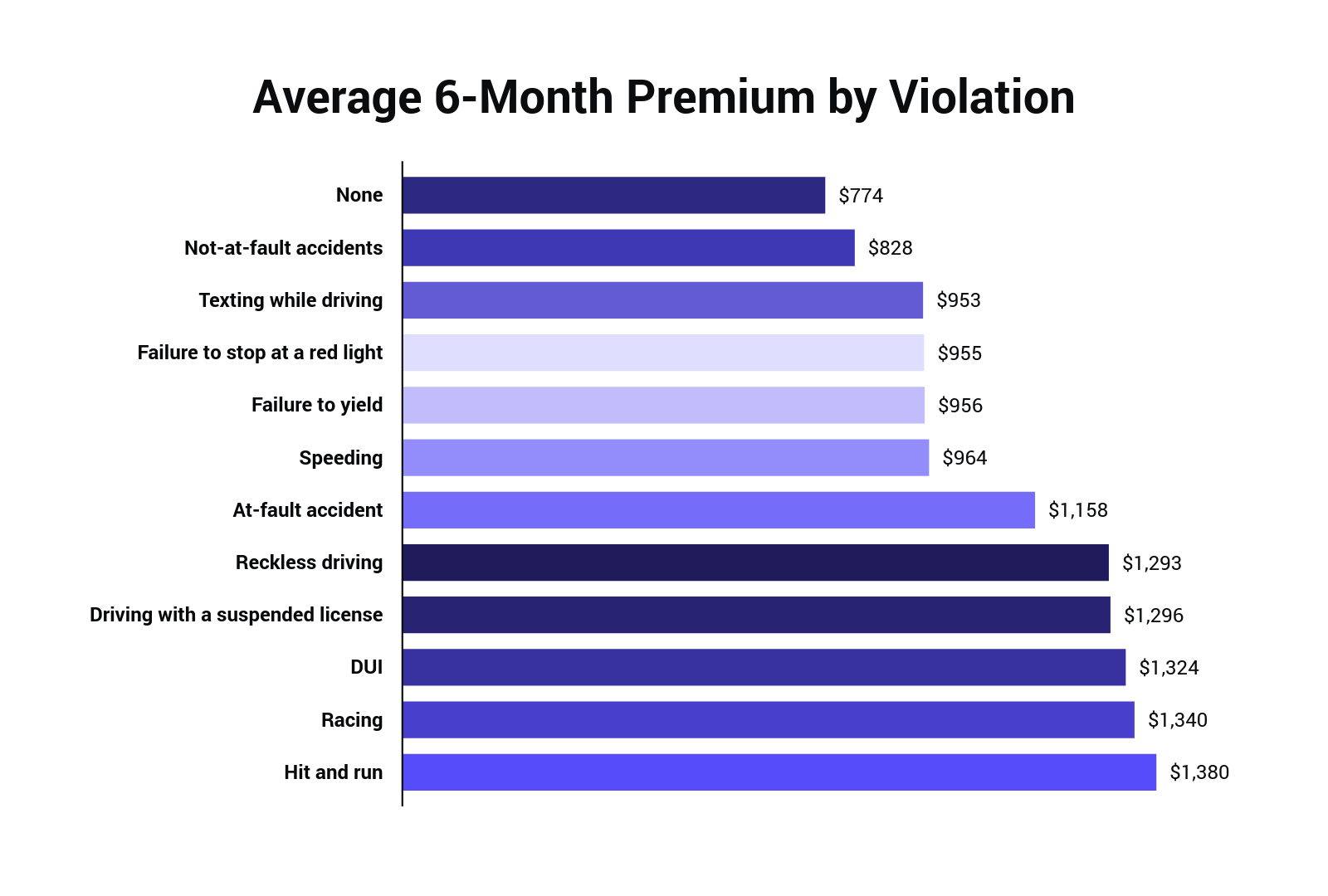

Icbc insurance rates for new drivers. Because new jersey has a large number of licensed drivers there are many insurance companies that provide car insurance policies to residents. Higher rates for some drivers. If you re a teen driver or a new driver every year of safe driving will help lower your rates until your age and experience are no longer factors in your car insurance costs.

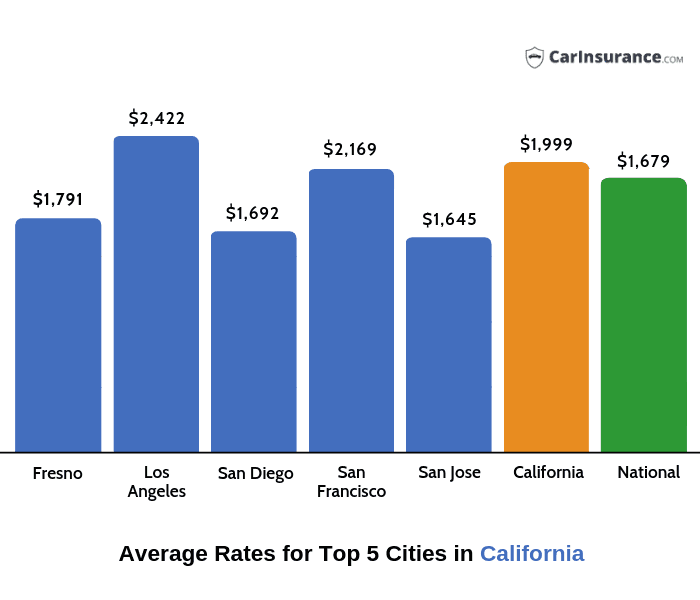

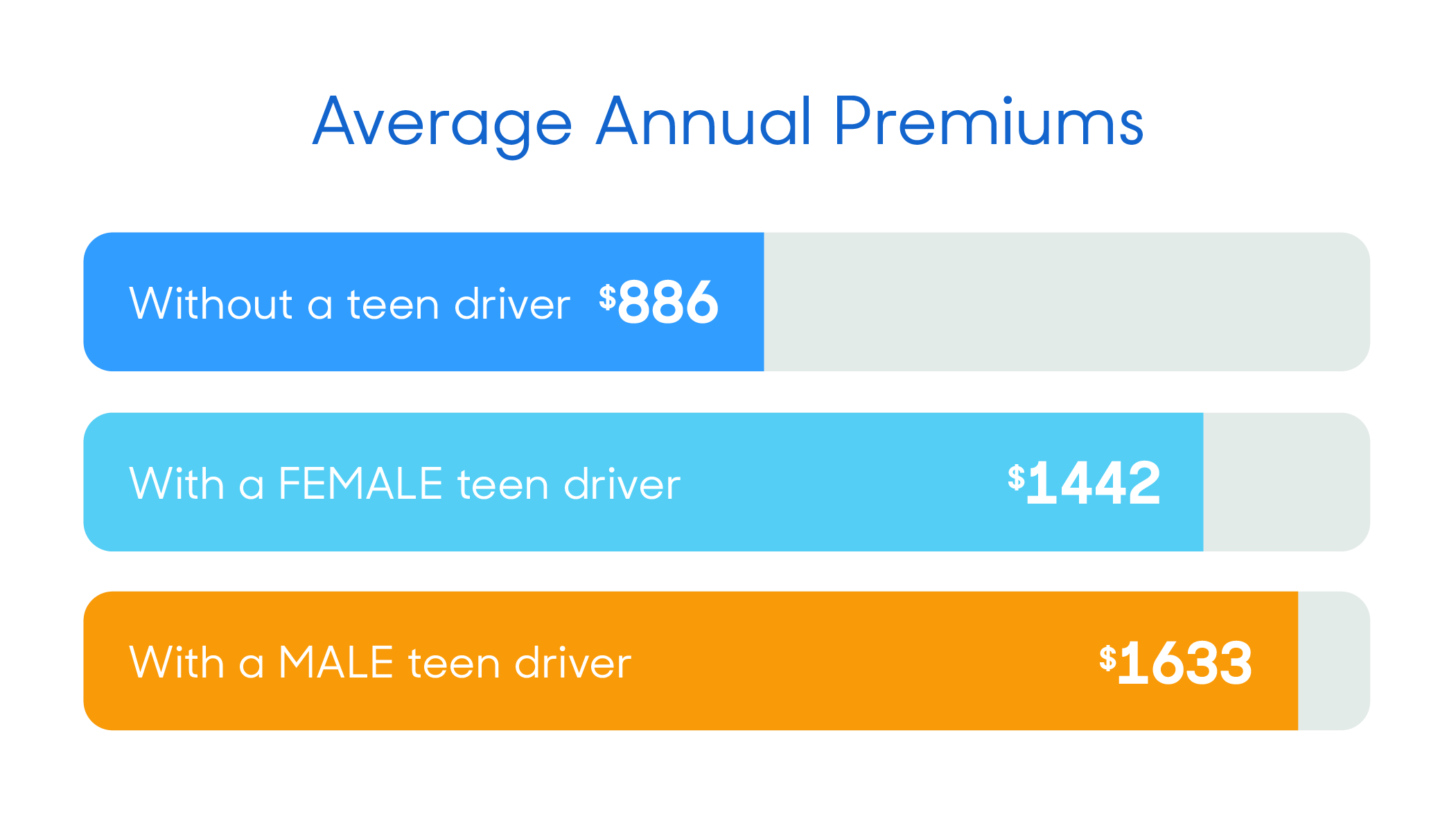

Every car insurance policy is tailored to every person s needs and quotes may be different as well depending on where you live and your concrete situation which is why it is usually advised to talk to your local agent and determine your priorities to get as much coverage as possible for less money finding that perfect balance. The young driver is the alluring things in the car insurance industry. As a new driver in ontario it is your responsibility to learn the rules and be safe on the roads. However one of the biggest factors that raises new driver rates is age.

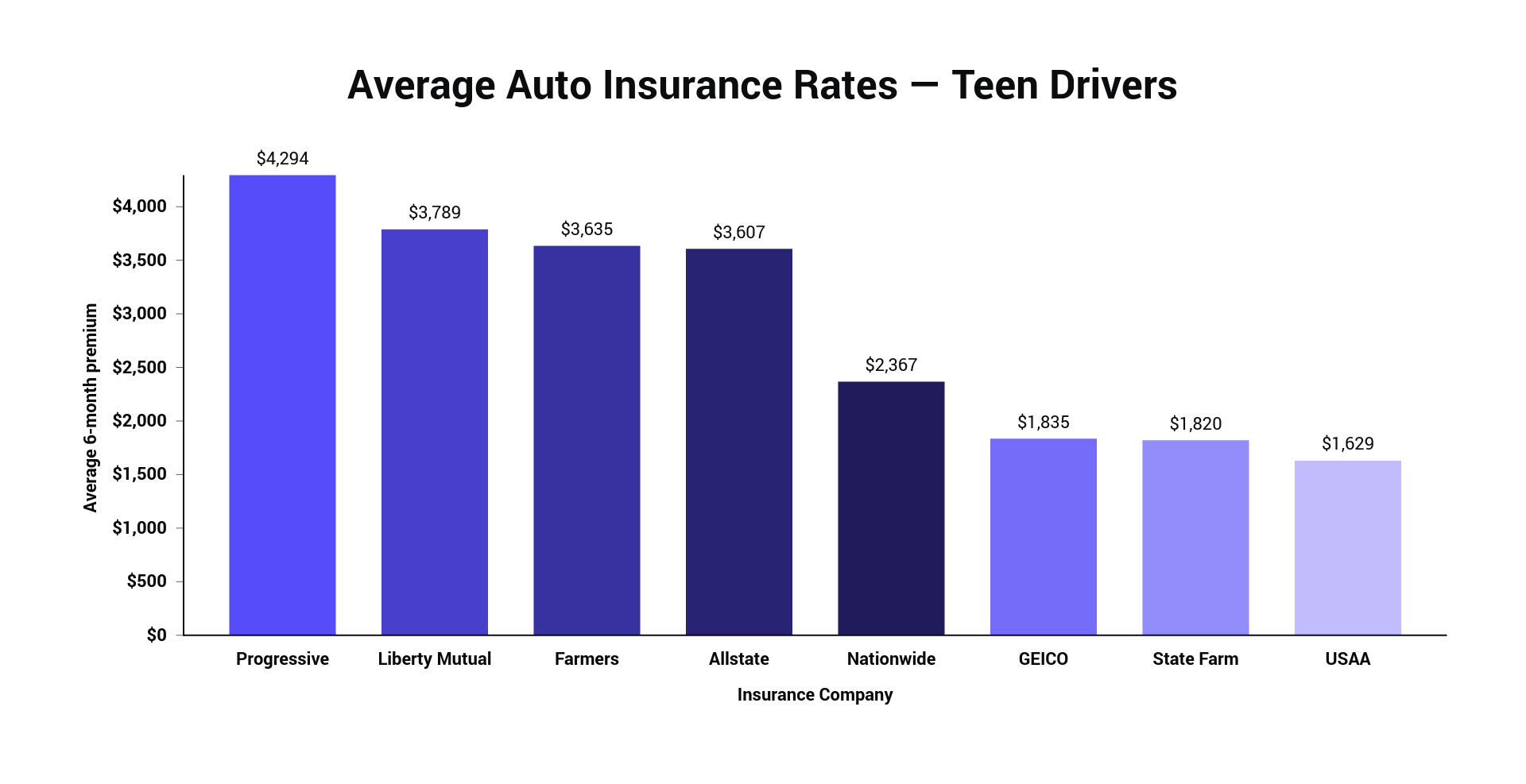

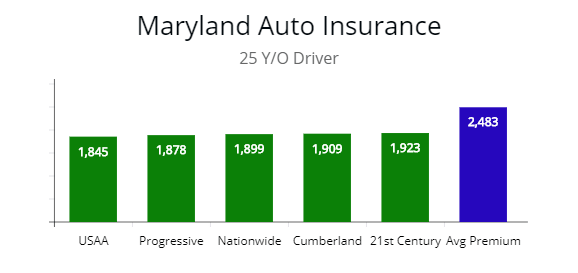

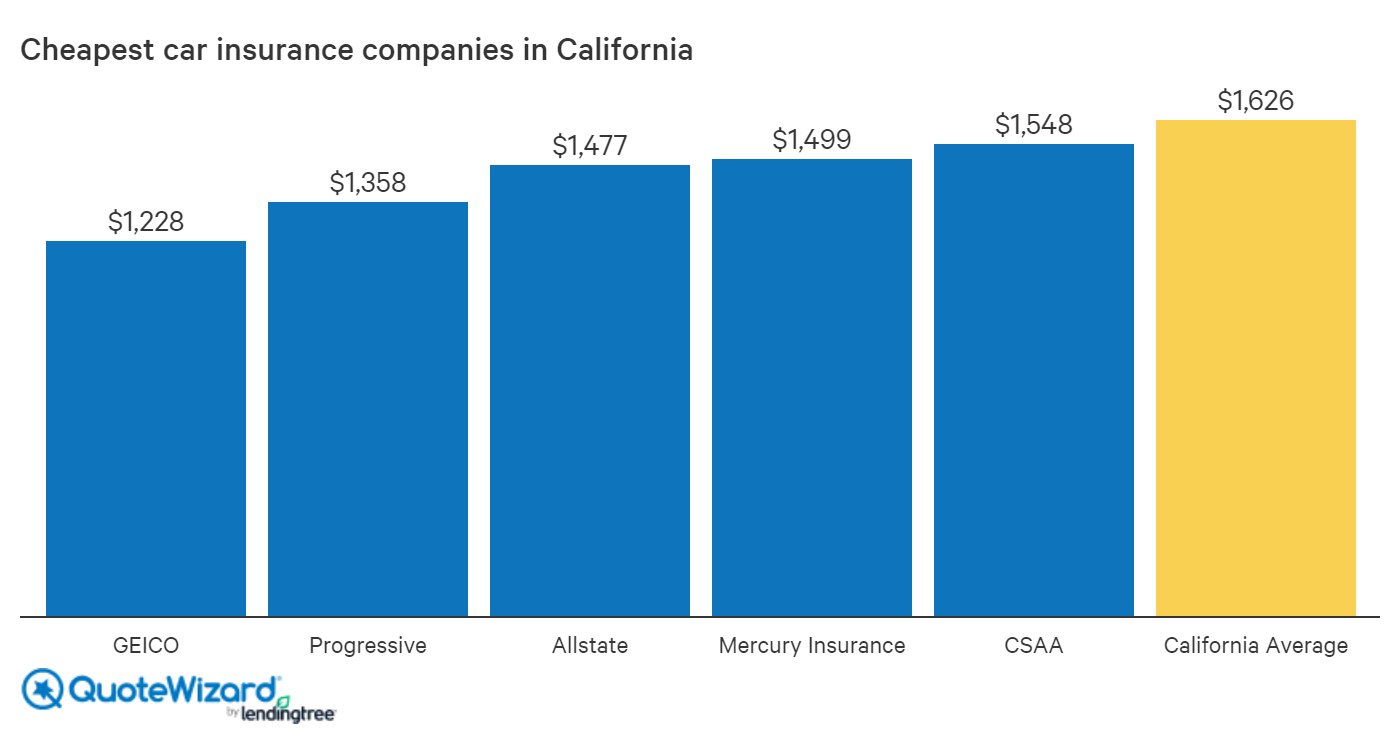

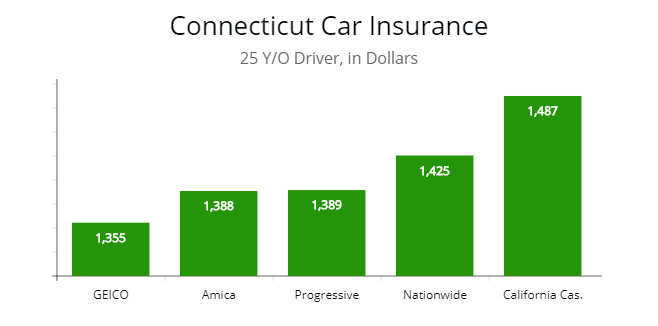

25 daily mileage discount calculation assumes. Even with all these tips the easiest way to save on expensive car insurance is to shop around online. You also deserve to get the best rates. By analyzing quotes from more than 20 auto insurance companies.

After a certain number of years of accident free driving you ll likely qualify for a safe driver discount. Unfortunately as a new driver car insurance companies will perceive you as a higher risk to insure and they will raise your rates accordingly. Drivers paying 837 for 6 months to their current insurer could find new rates as low as 378 for 6 months.