Car Insurance Florida Bad Credit

For example nerdwallet s 2019 vehicle insurance rate analysis shows that while state farm bills greater prices for bad credit report in several states it does not appear to do so in maine.

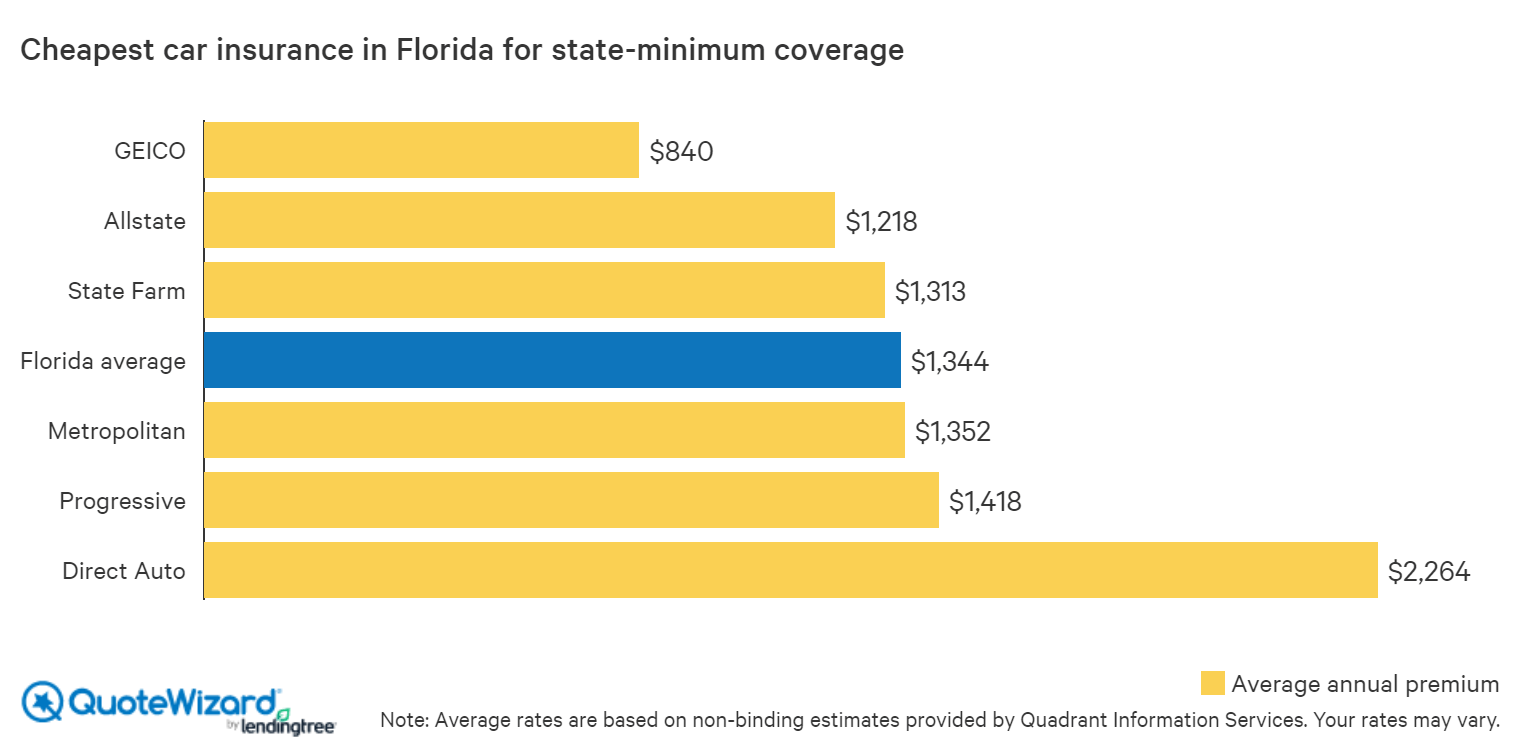

Car insurance florida bad credit. Car insurance rates with bad credit in florida florida drivers pay an average penalty of 2 130 annually for having a worst tier credit score. Bad credit auto insurance providers. Car insurance can be expensive even with safe driving and other available discounts. Compare car insurance quotes online.

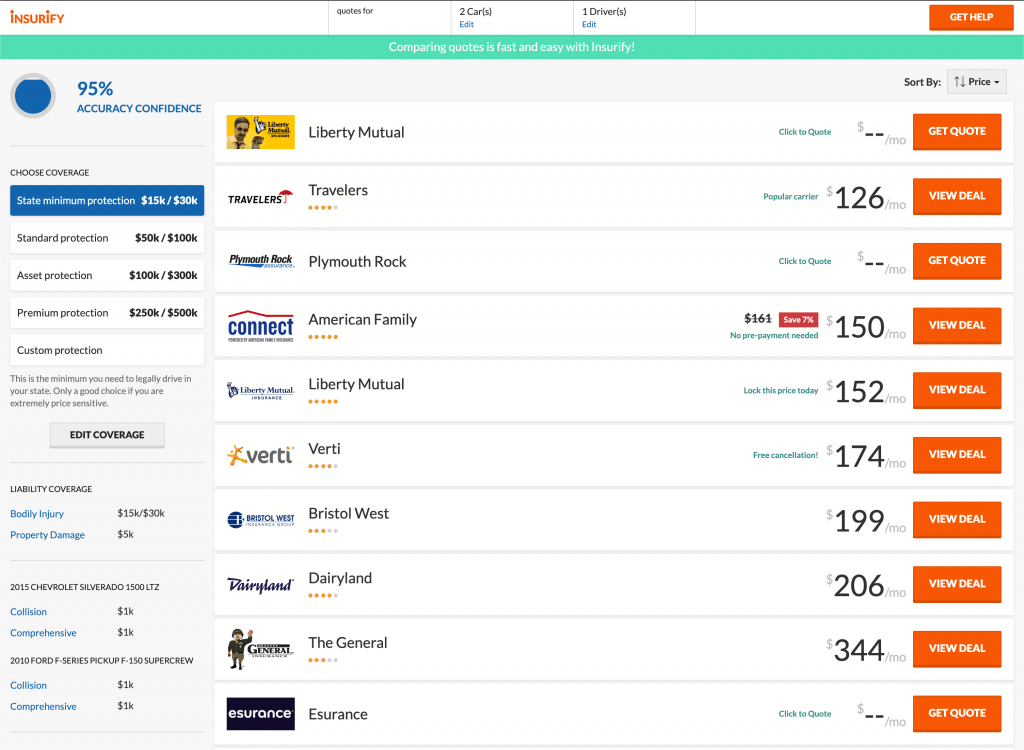

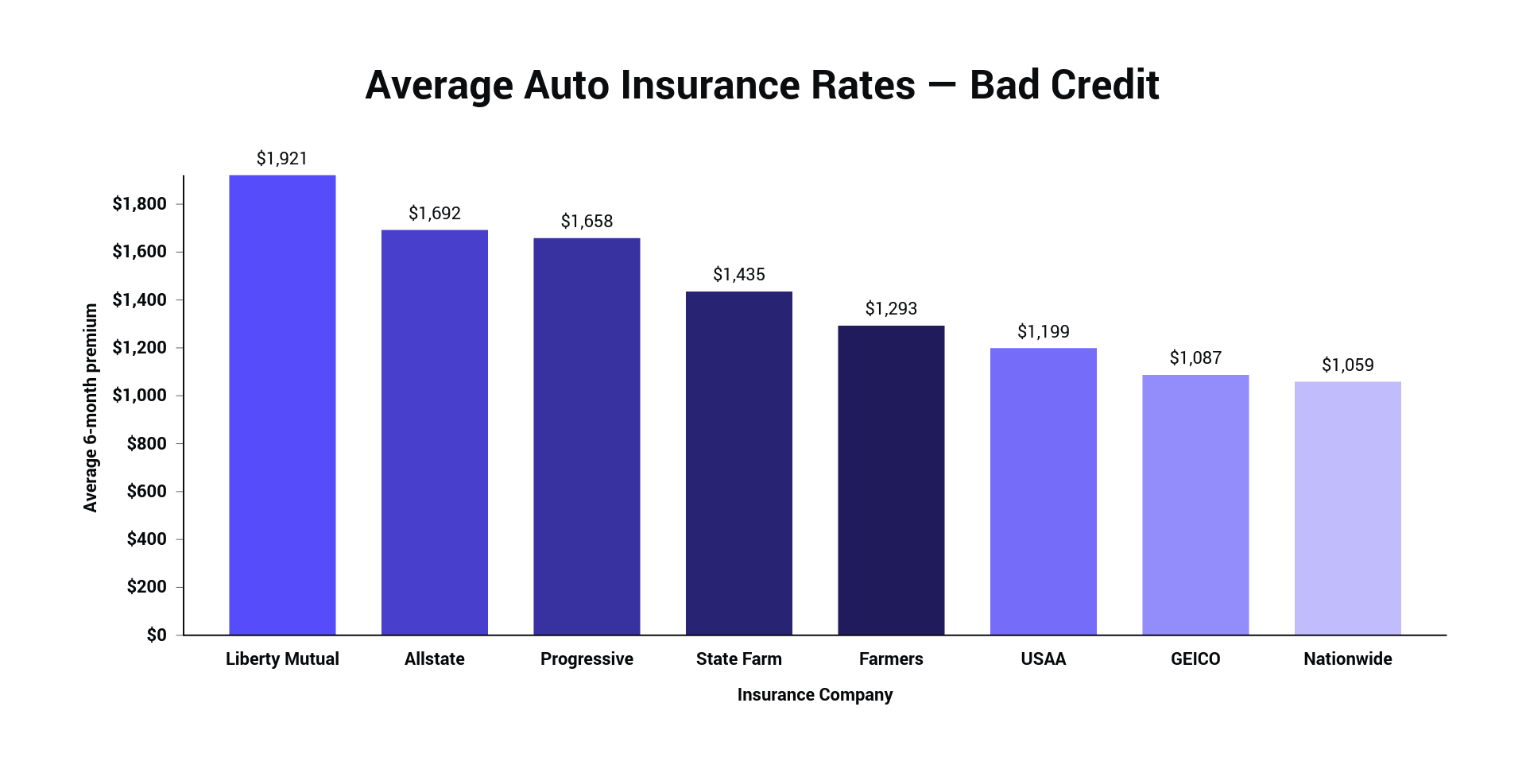

Getting car insurance if you re a driver with bad credit is not impossible and you might be able to pay monthly though it s likely a credit check would be involved. Others are more friendly for those with bad credit similar to credit cards for consumers with bad credit. For young drivers with blemished credit in florida here are the cheapest average rates we found for minimum required auto insurance coverage. If you have bad credit you might get a quote from a no credit check auto insurance company a bad credit auto insurance company and a few standard auto insurance companies as well as a usage based policy quote or two.

Affordable florida car insurance for bad drivers having a bad driving record can be a huge burden for getting cheap car insurance no matter your location. Some car insurance companies will increase your car insurance rate if you have bad credit. Compare your options for car insurance with bad credit to find the best cover for you. The policy with the lowest premiums is the best deal.

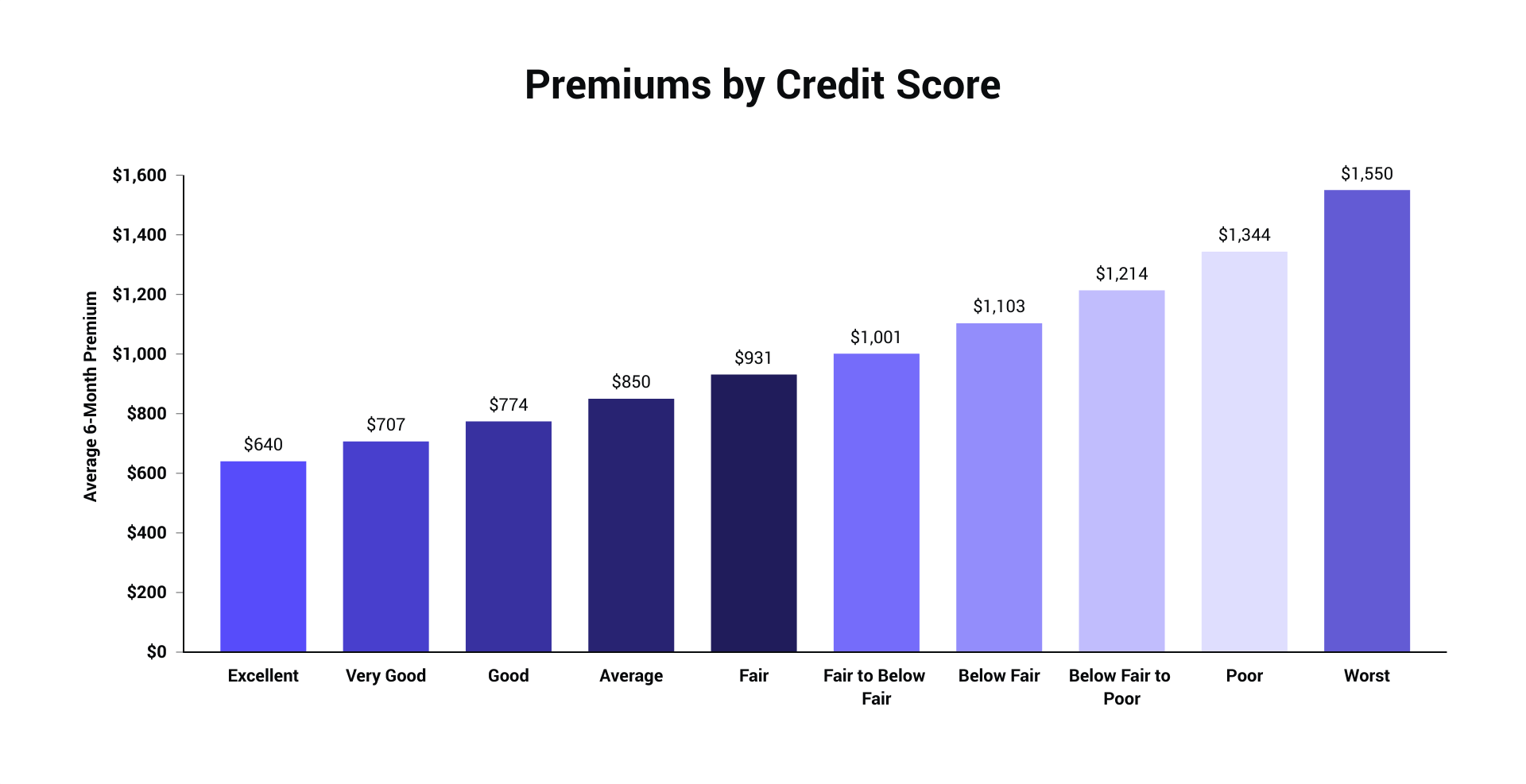

For more tips on keeping your rates low read our comprehensive guide to car insurance. In florida in 2017 a dui raised rates an average of 934 a year. More than 90 of insurance companies consider credit history as one of the factors when setting car and home insurance rates. A driver in either the poor or below fair to poor credit tier will also face higher than average rates.

Determining the ideal amount of auto insurance can be difficult. For those struggling with bad credit the price of car insurance can climb even higher.