Car Insurance Deductible For Taxes

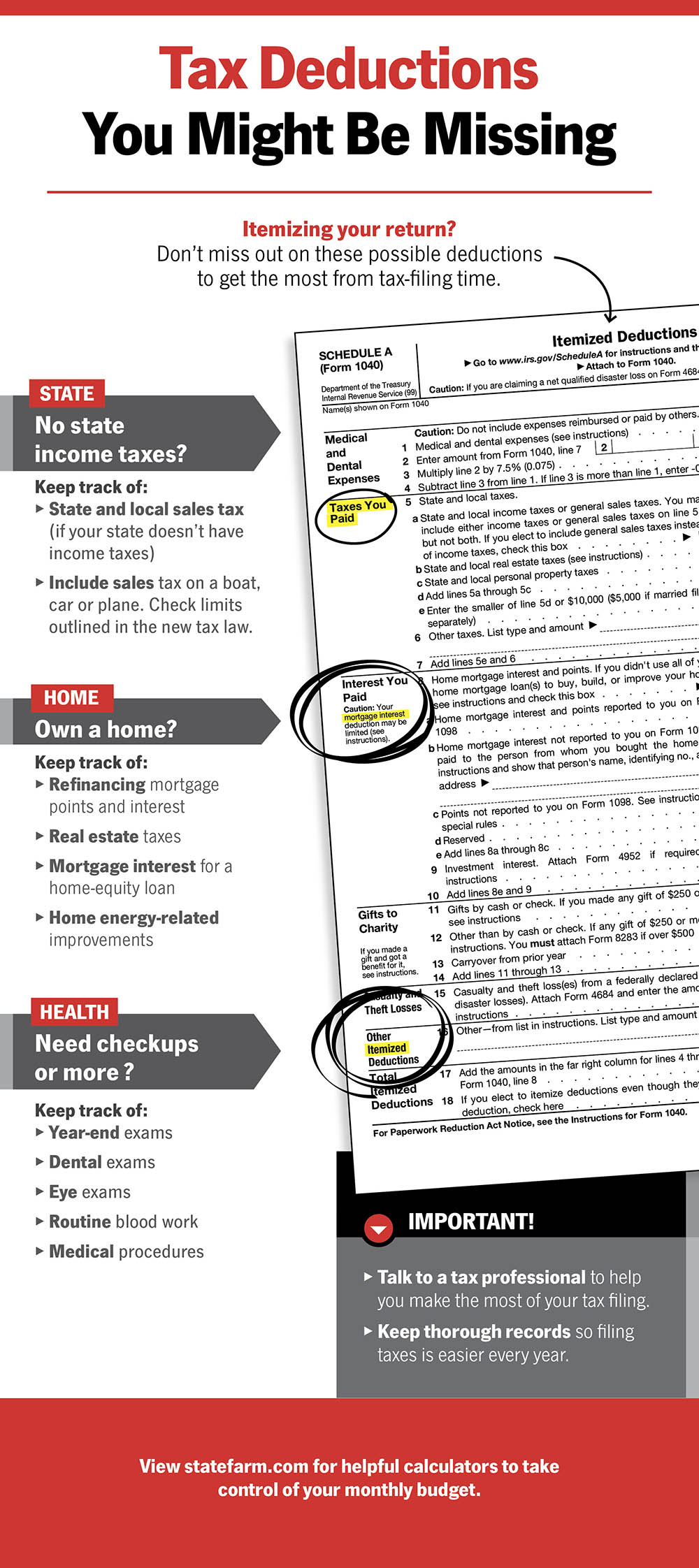

While this is a brief summary of car insurance related deductions our recommendation is to speak to a tax professional.

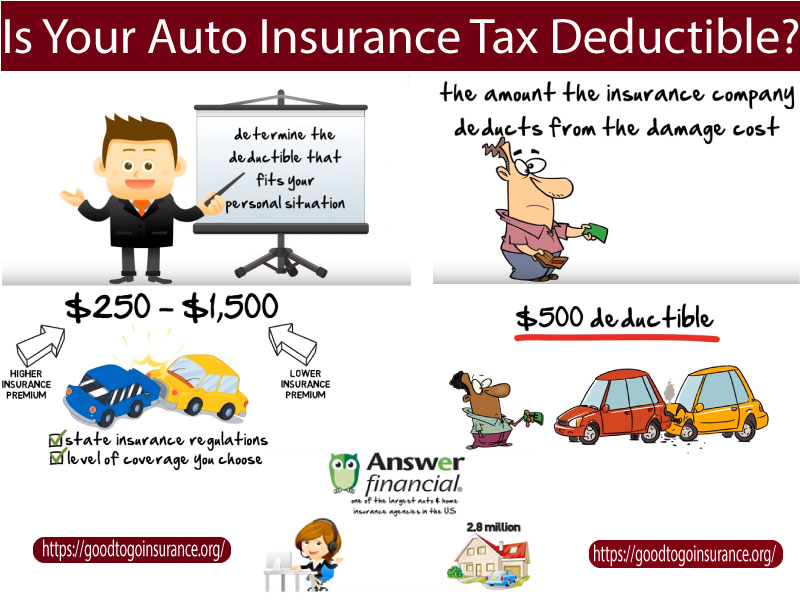

Car insurance deductible for taxes. After a car accident paying the deductible part of the repair bill is often painful. Your costs must be greater than 100 and more than 10 of your agi. However if the damage to your car exceeds your policy limits you can deduct the difference. Beginning with the tax year 2018 and thanks to the tcja you can only claim this itemized deduction if your vehicle was damaged or destroyed due to an event that the president has declared a disaster.

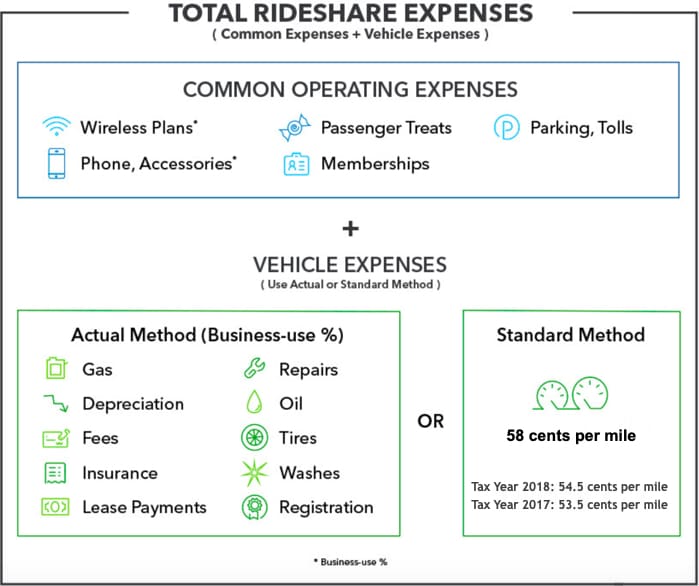

If you have 5 000 in expenses for example and use your car for business 50 percent of the time you would multiply 5 000 by 0 50 to arrive at 2 500. For instance if you are a landlord. If you drive a car for both personal and business uses you may deduct your insurance costs from your taxes for the percentage of the time you use your car for business. When you re self employed or a freelancer.

If you work for yourself and you use your car for your business or work it s likely that you ll be able to claim at least some of your car insurance premiums as a tax deduction. In special cases however they might be wholly or partially tax deductible as a business expense. If half the time you use your car is for business then you may deduct 50 of the yearly auto insurance costs on your taxes. How to deduct car insurance on tax returns.

Car insurance is tax deductible as part of a list of expenses for certain individuals. Writing it off on your taxes can reduce at least a little of the pain. Federal tax law does allow you to take a deduction for the accidental damage or theft of your car. When it comes to your personal taxes you do not want to take any chances.

There are a couple of ways to go about claiming auto insurance expenses as a tax deduction. It s important to discuss filing an auto related tax deduction with your accountant before sending your tax return. Here s what to expect in a few common situations. The car insurance tax deductions you re eligible for depend on the details of your employment status.

Employee or owner how much the deduction impacts your taxes is determined by the nature of your work. According to the irs businesses that own and are dependent on the use of company cars or a fleet of vehicles may deduct auto insurance as a business expense if it is for your trade business or profession. Generally people who are self employed can deduct car insurance but there are a few other specific individuals for whom car insurance is tax deductible such as for armed forces reservists or qualified performing artists. Of course it s possible your car expenses including auto insurance might not be tax deductible at all.

Homeowners insurance premiums are typically not tax deductible.