Car Insurance Deductible Difference

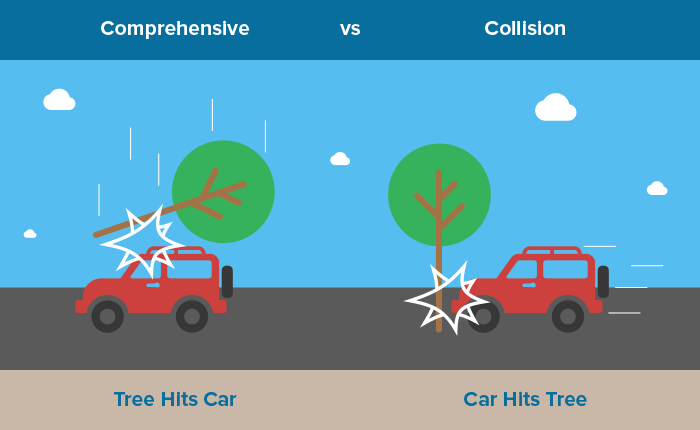

Comprehensive and collision coverage.

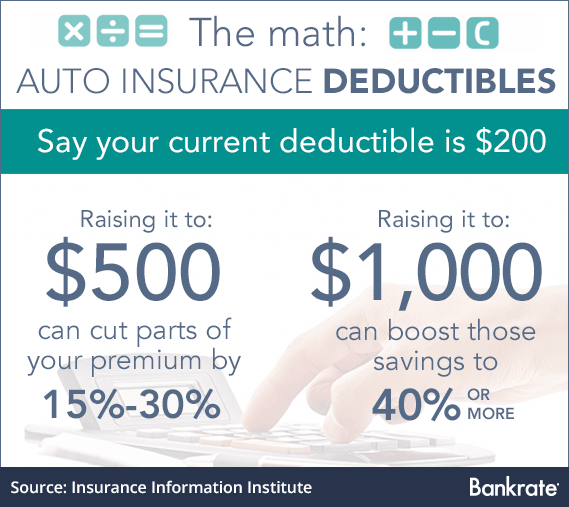

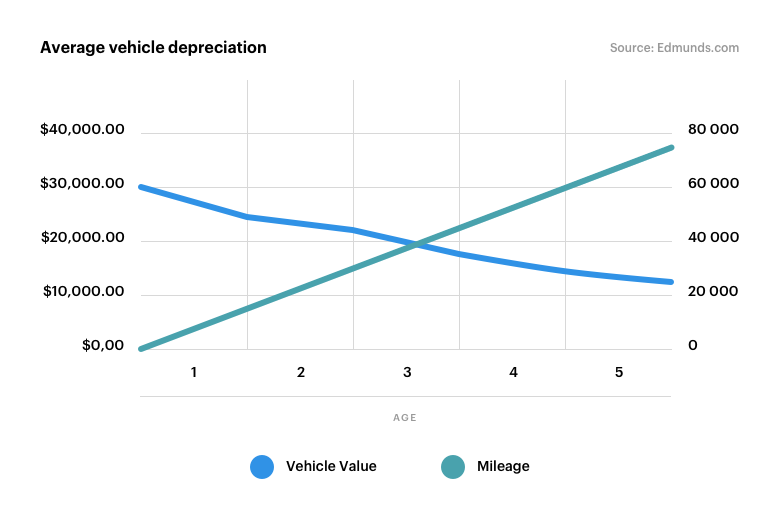

Car insurance deductible difference. A deductible is the amount you pay before your insurance kicks in. Insurance companies offer reduced rates when drivers increase their car insurance deductible amounts because drivers take on more risk making the policies less costly for the insurer this is an essential component of how car insurance works raising your deductible is a smart choice as long as you can afford the deductible if. Typically you can choose a deductible of 250 500 or 1 000 but amounts can go as high as 2 500. So if you hit someone else at a red light your insurance will pay the entire cost up to your coverage limits of repairs to the other driver s vehicle.

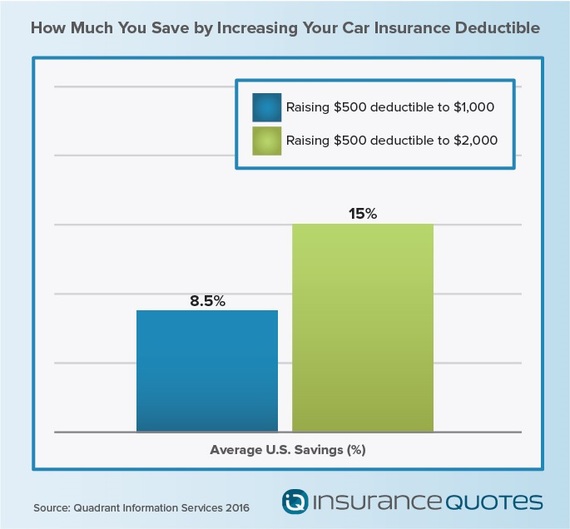

In other words a high deductible costs less up front but you pay a bigger portion of every claim. The car insurance deductible is a way for drivers to share. A car insurance policy with a 500 deductible could have a 1 500 annual premium for example while a policy with a 1 000 deductible might charge 1 337. A car insurance deductible typically applies only to the parts of your policy concerning damage to your property.

An auto insurance deductible is what you pay out of pocket on a claim. Auto insurance coverage will work the same whether you have a 100 or 1 000 deductible the only differences being your monthly bill. Before deciding on a car insurance deductible make sure to assess your financial situation. It s one of the most common car insurance questions and may be the easiest to answer.

You can save money on auto insurance by raising your deductible.