Car Insurance Cost Quebec Vs Ontario

How long coverage lasts.

Car insurance cost quebec vs ontario. As a quebec resident you ll even automatically get 5 off eligible coverage when using our online car insurance quoter. Well subtract 200 from the ontario average premium and ontario would still be the most expensive province for car insurance in canada so as i say it s not just fraud that s the problem. Auto insurance rates in quebec are determined by a number of factors including. A 2011 study compared both dollar cost and affordability of car insurance across canada.

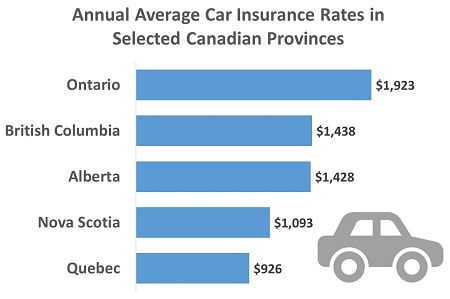

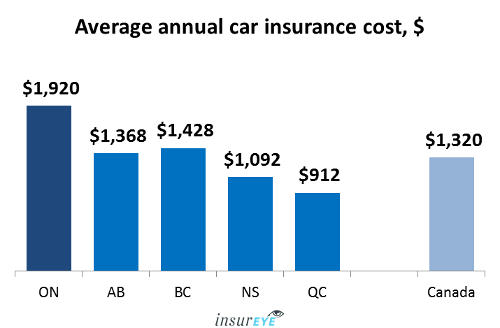

1 section 7 and subsection 13 1 do not apply to a motor vehicle owned by a person who does not reside or carry on business in ontario for more than six consecutive months in each year if the owner thereof is a resident of some other province of canada and has complied with the provisions of the law of the province in which the person. In 2016 ontario drivers paid on average 1 437 which is 19 per cent more for auto insurance than drivers in alberta and 65 per cent more than drivers in atlantic canada. It s fast efficient and will provide you with a personalized quote right now. In terms of affordability the quebec motorist required 2 5 percent of their disposable income to pay for car insurance compared to 4 5 for the ontario driver.

If you re looking for an auto insurance quote in quebec use our online quoter. Where to get it auto dealerships. Average car insurance costs in quebec were below 650 annually. Much of the process of buying a used car in ontario is similar to quebec.

Insurance brokers and agents. In ontario the same average driver paid about 1 500. Cost fixed price agreed to at the start. There are both public and private run insurance programs throughout the nation with saskatchewan manitoba and british columbia relying on provincial run coverage while the rest of canada is privately insured through multiple independent insurance companies.

Both seller and the buyer have some responsibilities. Buying a used car in ontario. Highway traffic act r s o. Although there are some differences.

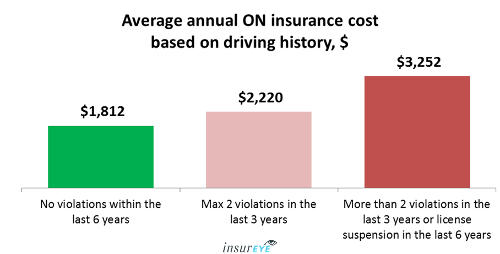

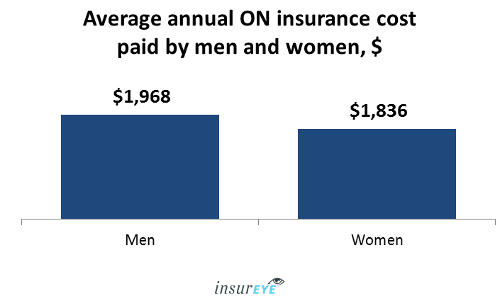

Based mainly on the value of the vehicle being insured. Proper insurance has to be in place. Usually 3 to 5 years. Young drivers in quebec pay more for insurance coverage though less than what their peers pay in ontario for comparable coverage.

Up to 8 years. Your age and gender. Certain insurance brokers and agents. According to the ibc auto insurance fraud costs ontario consumers up to 200 per year on their policies and the ibc is on record as enthusiastically supporting ontario s anti fraud initiatives.

While prices have changed since then relative patterns remain similar. Which is the civil liability insurance that provides no less than 50 000. Comparing car insurance in alberta and ontario.