Car Insurance Between Jobs

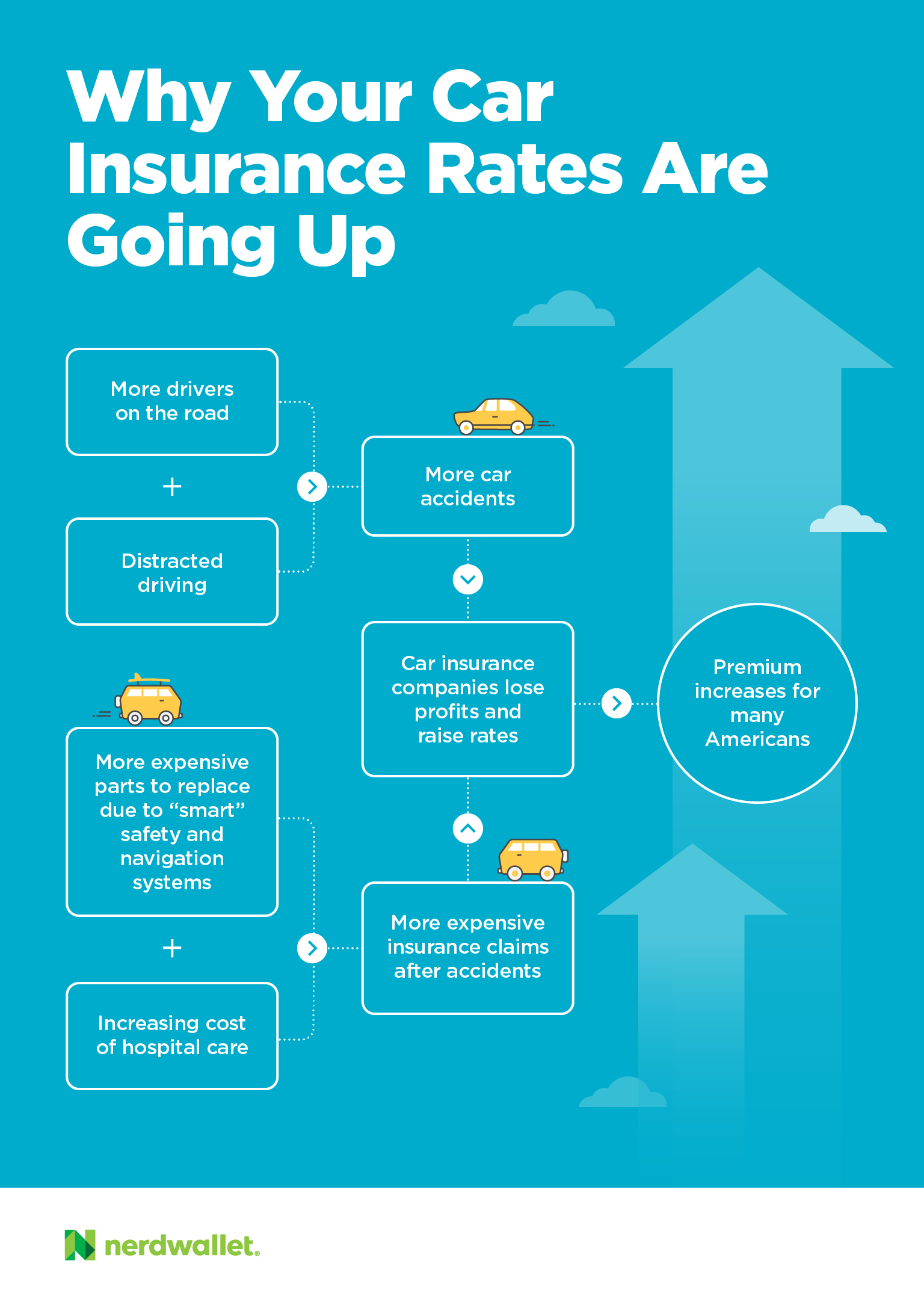

Car insurance is a lot more expensive if you don t have a job because insurers believe uninsured drivers are more likely to make a claim.

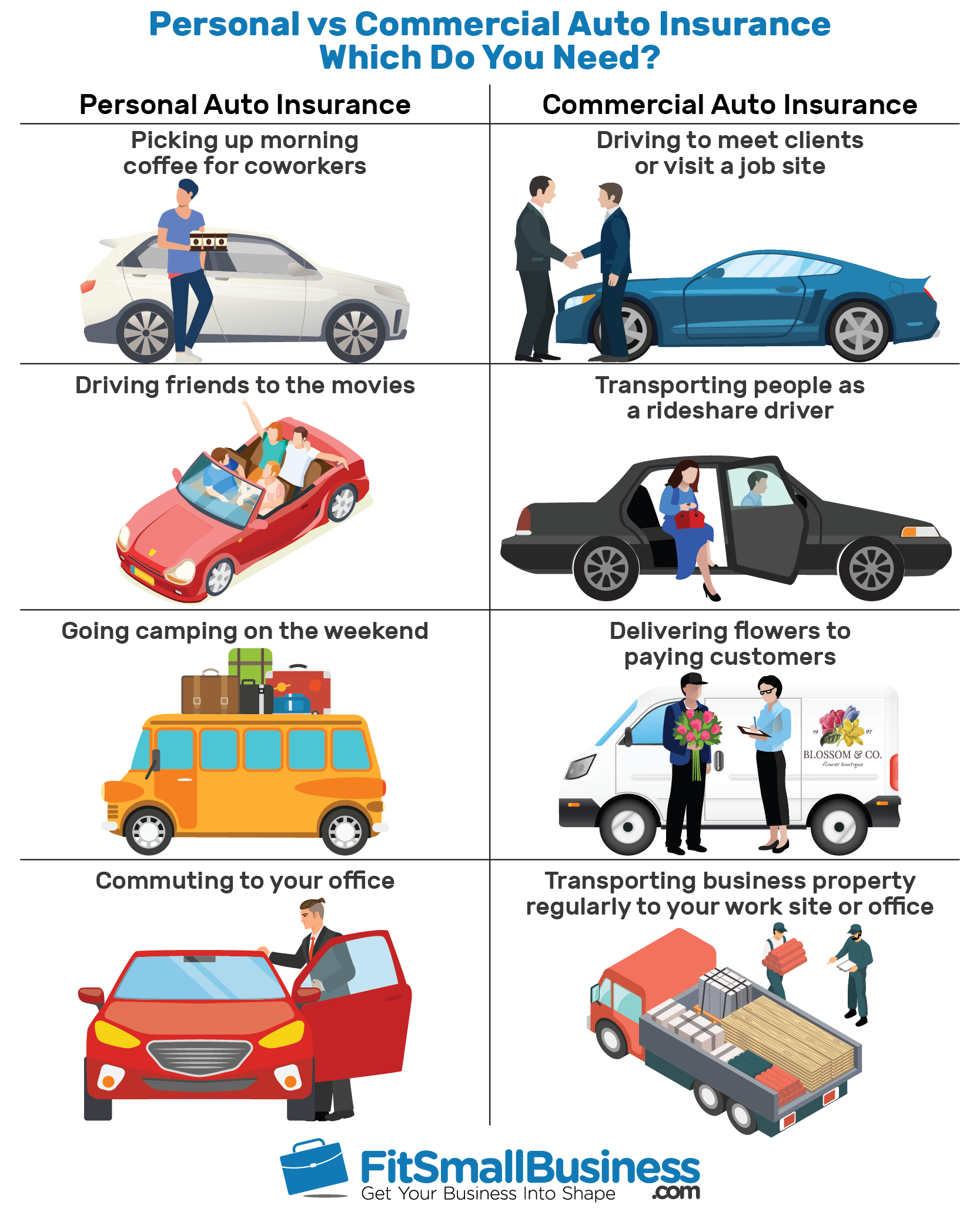

Car insurance between jobs. Directly between two separate workplaces for example when you have a second job if one of these places isn t your home from your normal workplace to an alternative workplace that is not a regular workplace for example a client s premises while still on duty and back to your normal workplace or directly home. If you do test the impact of different job titles on the cost of car insurance bear in mind that your stated occupation must accurately describe your profession. By contrast there are certain professions that attract far lower car insurance premiums and these include teachers police officers and solicitors. 1 using car insurance quotes made by customers on the site between 1 january and 31 december 2018 average best premiums for various occupations were.

But you want to take a few weeks off in between jobs. Workers who face more expensive car insurance premiums include journalists estate agents sales reps athletes and people who work in the entertainment industry. Tweaking your job title for cheaper insurance. If you leave your job for any reason and lose your job based insurance you can buy a marketplace plan.

Getting health insurance when you re between jobs a guide to the new rules under obamacare. For example you might find that a proof reader is a lower risk than an editor. Here are options to deal with a health insurance gap and get covered if you re unemployed or in between jobs. The weirdest job titles on car insurance quotes.

Losing your job can be traumatic especially when it means losing health insurance. The cost of your car insurance is a result of many factors including your age the car you drive where you live and your occupation. By beth orenstein june 19 2014. Insurers use what s called actuarial risk tables which show the different risks each group of people tends to have they ve built this up based on years worth of data.

Here are some which will make you scratch your head. Thankfully there are things you can do to help keep the cost down especially if you reduce your mileage dave merrick head of car insurance. This means you can buy insurance outside the yearly open enrollment period.